SAC code for labour charges textile chemicals is a specific classification used under GST to identify and determine the tax rate for labour services involved in textile processing like dyeing and bleaching.

Table of Contents

SAC Code for Labour Charges Textile Chemicals

When you’re involved in textile chemical processing—such as dyeing, bleaching, printing, or finishing fabrics—your work often falls under labour-intensive services. These services need to be properly classified using the correct SAC code for labour charges textile chemicals to ensure compliance under GST because:

- Accurate SAC code for labour charges textile chemicals is vital for GST compliance in dyeing, bleaching, printing, and finishing.

- This code identifies your service to tax authorities, determining the applicable GST rate (5% or 18%).

- Correct SAC code for labour charges textile chemicals ensures valid invoices.

- It enables clients to claim Input Tax Credit (ITC) without issues.

- Using the right SAC code for labour charges textile chemicals protects against penalties during tax audits.

- Proper classification builds trust through professional and accurate tax handling.

- The SAC code for labour charges textile chemicals is a key aspect of responsible business operation.

In short, the SAC code for labour charges textile chemicals is not just a tax requirement—it’s a key element of how you run your business responsibly.

Labour Charges in Textile Processing

In the context of textile processing, labour charges refer to the fees or costs associated with the human effort, time, and skill involved in carrying out various treatment processes on textile materials. These charges form a significant component of the cost structure in textile services and are crucial for accurate GST classification and billing under the SAC code for labour charges textile chemicals.

Here’s a breakdown of what labour charges typically include in this industry:

1. Wages and Salaries

These are payments made to skilled and unskilled workers engaged in processes such as:

- Dyeing

- Bleaching

- Printing

- Finishing

- Material handling

- Quality control

2. Direct Labour Costs

These are costs that can be directly attributed to a specific process.

For example:

- Wages paid to a dyer operating the dyeing machine

- Payments to a technician running the printing press

3. Service Fees (in Job Work)

When a textile job is outsourced to a third-party processor, the charges may appear as a consolidated service fee.

This fee typically covers:

- Labour costs

- Overhead

- A profit margin

4. Handling and Internal Transport

This includes manpower costs for moving materials between processing stages within the plant, such as:

- Shifting fabric from dyeing to drying

- Transferring textiles between machines

5. Supervisory Costs (Directly Related)

Part of the salary of supervisors who are:

- Directly overseeing processing operations

- Managing workflow and quality during chemical treatment

6. Preparation and Setup Labour

Labour involved in:

- Preparing machinery

- Mixing chemicals

- Setting up for a new production batch

Various SAC Codes for Labour Charges

When it comes to applying GST correctly to labour services, it’s important to know that not all labour charges fall under a single SAC code. The classification depends on the nature of the work, whether materials are included, and the sector in which the service is provided.

Below is a breakdown of the most relevant SAC codes and GST rates for different types of labour services, with a focus on labour charges for textile chemical processing.

Pure Labour Supply (No Materials): 998519

- SAC Code: 998519

- Description: Manpower supply without materials

- GST Rate: 18%

- Use: General textile labour, not processing

Textile Chemical Job Work: 998832

- SAC Code: 998832

- Description: Processing on goods owned by others (Textiles)

- GST Rate:

- 5% – Non-transformative (dyeing, washing)

- 18% – Transformative (bleaching, printing)

- Use: Main code for textile processing job work

Works Contract (Labour + Materials): 9954/9988

- SAC Code: 9954 / 9988

- GST Rate: 18%

- Use: Labour + chemicals/dyes (composite supply)

Agricultural Labour: 9986

- SAC Code: 9986

- GST Rate: 0% (Exempt)

- Use: Farming-related labour

Construction Labour under Govt. Schemes: 9954

- SAC Code: 9954

- GST Rate: 0% (Exempt if notified)

- Use: Labour for affordable housing projects

| Labour Type | SAC Code | GST Rate | Context |

| Pure Labour Supply (No materials) | 998519 | 18% | Manpower without supply of materials |

| Textile Chemical Job Work (Labour only or with chemicals) | 998832 | 5% or 18% | Job work in textile processing |

| Works Contract (Labour + materials) | 9954 / 9988 | 18% | Composite supply of services + materials |

| Agricultural Labour | 9986 | 0% | Labour services in farming |

| Labour for Affordable Housing Construction | 9954 | 0% | Subject to notification-based exemptions |

GST on Textile Labour Charges

The GST rate on textile labour charges is not a fixed percentage. It depends largely on the nature of the service provided, whether it’s job work, pure labour supply, or a transformative process, and on the correct use of the SAC code for labour charges textile chemicals.

Let’s break it down by SAC code category and situation:

| SAC Code | Service Type | GST Rate | Remarks |

| 998832 | Job work on textiles (non-transformative) | 5% | Dyeing, washing, finishing – on goods of registered persons |

| 998832 | Job work on textiles (transformative) | 18% | Bleaching, printing – changes fabric character |

| 998821 | Textile manufacturing services (general) | 18% | Broader manufacturing not qualifying as job work |

| 998519 | Labour supply (no processing) | 18% | Pure manpower supply – no materials or processing |

Key Points

- SAC code for labour charges textile chemicals depends on the nature of processing.

- 5% GST: Non-transformative job work on registered clients’ goods (Ch. 50–63).

- 18% GST: Transformative processes or unregistered clients.

- Use 998519 for labour-only services, not chemical processing.

- Ensure accurate SAC code & process description on invoices.

- Stay updated with GST Council circulars.

Service vs. Manufacturing Confusion

Under GST, processing goods belonging to another registered person is treated as a service, not manufacturing. This is known as job work, as per Schedule II of the CGST Act, 2017.

Even if the process (like bleaching or printing) alters the fabric’s look or properties, it’s still a service as long as the goods belong to the client and no new product is created.

Key Points

- Not manufacturing unless a new product with a different name, character, or use is formed

- SAC code for job work on textiles: 998832

- GST rate:

- 5% for basic job work (dyeing, washing)

- 18% for transformative processes (bleaching, printing)

- Invoice clearly with job work description and correct SAC code

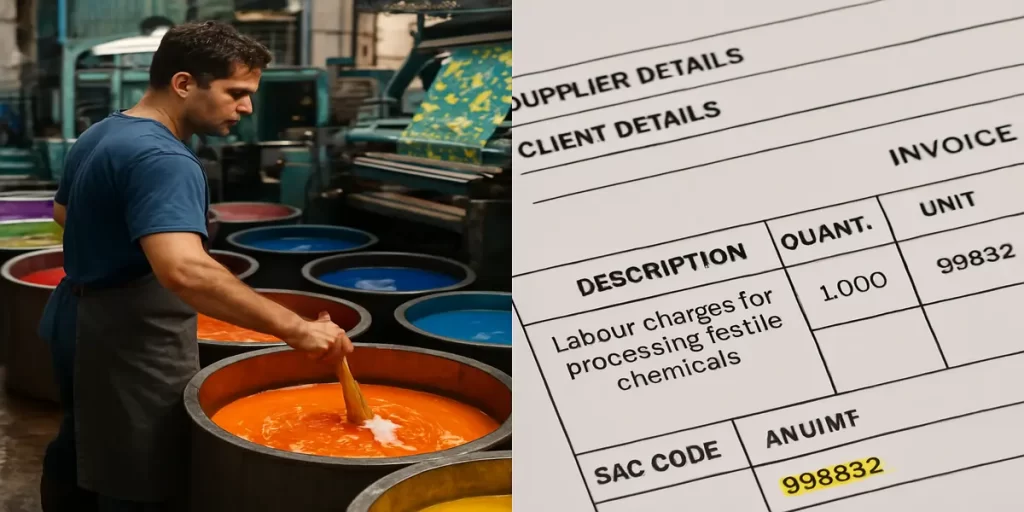

Invoicing with Correct SAC Code

Here’s a step-by-step guide on how to invoice correctly with the appropriate SAC code for labour charges in textile chemicals:

| Section | Field | Example / Notes |

| 1. Supplier Details | Supplier Name | [Your Company Name] |

| Supplier GSTIN | [Your GSTIN] | |

| 2. Client Details | Client Name | [Client Company Name] |

| Client GSTIN | [Client’s GSTIN] (mandatory if registered) | |

| Address (if unregistered and value > ₹50,000) | Include full address, state name, and state code | |

| 3. Invoice Info | Invoice Number | [Unique, consecutive, max 16 characters] |

| Invoice Date | [Date of issue] | |

| 4. Service Details | Description of Service | Job work charges for dyeing of 1000 meters of cotton fabric using reactive dyes |

| Quantity | 1000 | |

| Unit | MTR | |

| SAC Code | 998832 | |

| Taxable Value | ₹ [Amount] | |

| GST Rate | 5% (or 18% for transformative processes) | |

| CGST (%) | 2.5% | |

| CGST Amount | ₹ [Amount] | |

| SGST/UTGST (%) | 2.5% | |

| SGST/UTGST Amount | ₹ [Amount] | |

| IGST (%) | Leave blank for intra-state; use 5%/18% for inter-state | |

| IGST Amount | ₹ [Amount] if applicable | |

| Total Invoice Value (Incl. GST) | ₹ [Final amount] | |

| 5. Other Info | Place of Supply | [Client’s State Name & State Code] |

| HSN Code (if goods supplied) | [Only if dyes, chemicals, or consumables are supplied along with labour] | |

| Reverse Charge (Yes/No) | Typically “No” for organized job work | |

| Signature / Digital Signature | [Your authorized signatory] |

Quick Notes:

- SAC Code 998832 is for job work in textile processing

- Use 5% GST if the service is basic job work on registered person’s goods

- Use 18% GST for transformative processes (e.g., bleaching, advanced printing)

- If it’s pure labour supply only, unrelated to textile processing, consider SAC 998519 at 18%

- Clearly describe the nature of service on the invoice to support GST classification

- Make sure the place of supply is correct to determine CGST/SGST or IGST

Verify Your Current SAC Codes

| Step | Action |

| Review Invoices | Check past usage of SAC code for labour charges textile chemicals |

| GST Portal | Search SAC 998832 (job work), 998519 (pure labour) via www.gst.gov.in |

| CBIC Website | Download official SAC list from www.cbic.gov.in |

| SAC Code Use | 998832: Textile job work (5%/18%) 998519: Labour only (18%) |

| Invoice Update | Ensure invoices list correct SAC code and GST rate |

| Stay Updated | Monitor GST/CBIC updates and textile sector advisories |

| Corrections | Rectify SAC errors with credit notes, GST return revisions |

Consequences of Using the Wrong SAC Code

| Issue | Impact |

| Financial Penalty | ₹25,000 (CGST) + ₹25,000 (SGST) for wrong SAC code invoicing |

| 10%–100% penalty on tax shortfall | |

| Client Risk | Clients may lose ITC on textile job work |

| Compliance Issues | GST return mismatches, audit risks, invoice invalidation |

Why Expert Help Matters

- Correct SAC code for labour charges textile chemicals avoids penalties

- Experts distinguish job work (5%) vs. manufacturing (18%)

- Helps with proper invoice wording & SAC selection

- Ensures ITC eligibility and peace of mind

How to Find the Right Expert

- Search for GST consultants in your region

- Look for textile industry experience

- Verify credentials (e.g., Chartered Accountant)

- Discuss your exact services to get tailored SAC code advice

Conclusion

We are summarising the main highlights of the SAC code for labour charges textile chemicals as below:

- SAC Code 998832: Main code for textile chemical job work.

- GST Rates: 5% (basic job work for registered clients) or 18% (transformative processes, pure labour, works contracts, unregistered clients).

- Accurate Invoicing: Essential with correct SAC code and GST rate.

- Job Work: Usually processing registered client’s goods for 5% GST (unless transformative).

- Transformative Processes (Bleaching, Printing): Likely 18% GST.

- Stay Updated: Check GST portal and CBIC for latest rules.

- Wrong SAC Code: Can lead to penalties and ITC issues for clients.

- Verify Codes: Use GST portal and CBIC lists.

- Information Only: Consult official sources for specific advice.

Also Read: Textile Chemicals: The Secret Sauce Behind Your Clothes