The latest news for textile chemicals reveals a dynamic industry transformation in 2025, fueled by sustainability mandates, surging global demand for performance textiles, and a decisive shift toward eco-friendly, biodegradable chemical solutions. This momentum is further propelled by tightening international regulations, strategic export realignments, and breakthrough innovations in green chemistry—firmly positioning textile chemicals at the forefront of sustainable industrial evolution. The following sections explore the most influential trends, regulatory updates, market shifts, and innovation drivers shaping the textile chemicals industry this year.

Table of Contents

News for Textile Chemicals: Key Drivers

- Sustainability Shift: Growing consumer and regulatory pressure is pushing textile chemical manufacturers to adopt greener solutions, such as biodegradable and eco-friendly chemicals. Companies are increasing investments in R&D for bio-based feedstocks, enzyme-based chemicals, and reduced chemical waste technologies.

- Market Growth: The global textile chemicals market is projected to reach ~$33.1 billion by 2026, driven by the increasing demand for performance textiles and environmental regulations.

- Export Potential: The shift away from Chinese imports, encouraged by the US “America First” policy, is opening up export opportunities for Indian textile chemical manufacturers. Gujarat, which has a 70% share in India’s dye manufacturing, stands to benefit significantly.

Green Chemistry Innovations

- Biodegradable Chemicals: The textile sector is increasingly shifting towards biodegradable alternatives that reduce environmental impact. Innovations like these are aligned with market demands for eco-friendly solutions.

- Circular Economy: Several major companies are integrating circular economy principles into their supply chain by focusing on recycling, reducing chemical waste, and ensuring sustainable sourcing. This is a direct response to both regulatory pressures and the growing demand for greener products.

Latest Industrial Shifts

- Shift Toward Sustainability: Major manufacturers are adopting more sustainable production methods, focusing on eco-friendly chemical formulations and reducing environmental footprints. The growing importance of technical textiles is influencing the chemical formulations used in the production processes.

- Performance-Driven Chemicals: Companies like BASF, Archroma, and DowDuPont are developing textile chemicals that offer enhanced performance characteristics, such as flame retardancy for firefighter suits or UV protection for construction textiles.

- Supply Chain Impact: With global disruptions in supply chains, particularly with raw material costs, companies are adapting by focusing on more resilient and localized sourcing strategies, ensuring they remain competitive in both the domestic and global markets.

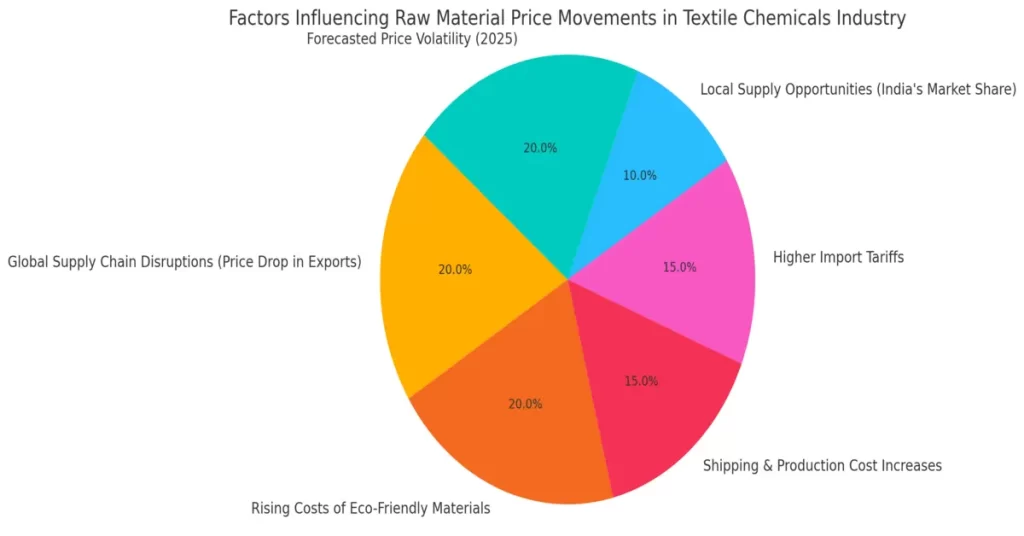

Price Movements & Raw Material Trends

- Supply Chain Insights: The price of raw materials like dyes, surfactants, and textile additives is directly affected by global logistics challenges. Buyers must consider:

- Increased shipping and production costs due to ongoing global disruptions

- Higher tariffs imposed on imports, potentially increasing the cost of raw materials

- Local Supply Opportunities: India is expected to capture a larger share of the global textile chemicals market, especially as restrictions on China’s exports increase.

- Forecast for 2025: Textile chemical buyers should expect continued price volatility, especially for eco-friendly chemicals, as demand rises. Monitoring raw material availability and exploring long-term contracts may provide stability in pricing.

New Global & Indian Regulatory Updates

Indian Regulatory Framework

- BIS Norms: New Bureau of Indian Standards (BIS) regulations are influencing textile chemical manufacturers in India. These norms are becoming stricter for chemical imports, ensuring better quality and safety standards. Indian manufacturers must comply with these standards to remain competitive in the global market.

- Indian GST Updates: The Goods and Services Tax (GST) structure continues to impact the pricing and invoicing practices of textile chemical companies, including those in job work services. Businesses need to be compliant with new invoicing practices and tax classifications for labor charges in textile chemical processing.

Global Regulatory Framework

- REACH Rules (EU): The Registration, Evaluation, Authorization, and Restriction of Chemicals (REACH) rules in the European Union are becoming stricter. Companies must comply with regulations related to the environmental impact of chemicals used in textiles. Manufacturers will need to adapt their formulations to meet these standards.

- Sustainability Mandates: New environmental regulations are pushing textile chemical companies to adopt more sustainable practices, including chemical recycling, waste reduction, and the use of biodegradable chemicals.

Export Trends and Demand Forecast for 2025

Export Trends

- India’s textile chemicals sector is experiencing a shift in export dynamics. Following global trade realignments and restrictions on Chinese imports, India’s share in the global market is projected to grow.

- US Market: India’s chemical exports to the US, which stood at $2.863 billion in 2023-24, are expected to recover. The Trump administration’s tariffs on Chinese products could open up opportunities for Indian manufacturers to capture market share.

- Techtextil 2026: The fair will highlight the increasing demand for textile chemicals in technical textiles, opening up further export prospects for Indian manufacturers.

Demand Forecast for 2025

- The Indian textile chemicals market is expected to see growth driven by both domestic demand and global export opportunities. Exporters will need to position themselves to meet the rising demand for eco-friendly and performance-enhancing chemicals, especially for technical textiles.

Finishing Agents, Dyes, and Enzymes on the Rise

Finishing Agents

- Growth in Demand: Finishing agents are expected to see a significant rise in demand due to their role in adding essential functional properties to textiles, such as water resistance, flame retardancy, and UV protection.

- Sustainability Focus: The shift toward bio-based finishing agents aligns with the push for sustainability in textile manufacturing, leading to eco-friendly alternatives.

Dyes

- The dyes market is witnessing a surge, especially in the production of technical textiles. Companies like DyStar and Clariant are introducing environmentally friendly dyes that minimize water usage and reduce toxicity.

Enzymes

- Enzyme-based chemicals are seeing increased adoption in textile processing for applications such as dyeing and finishing. These enzymes offer reduced environmental impact compared to traditional chemicals, making them a go-to option for manufacturers focused on sustainability.

Insights from Textile Chemical Innovators

The latest news for textile chemicals highlights key advancements and strategies that are shaping the future of the industry. The following table outlines the significant R&D investments, strategic collaborations, and innovative solutions driving sustainability and performance in textile chemicals.

| Key Area | Details |

| R&D Investments | AkzoNobel and DowDuPont are focusing on sustainable chemical solutions, including biodegradable chemicals, waste reduction, and fabric quality improvement. |

| Strategic Collaborations | Companies are partnering with textile manufacturers to develop solutions for industries like automotive, medical textiles, and protective clothing. |

| Innovative Solutions | Techtextil 2026 will showcase innovations in high-performance textiles, with a focus on durability, flame resistance, and water repellency. |

| Sustainability Pioneers | Archroma is leading the development of eco-friendly chemical formulations, such as Smartrepel Eco, addressing both consumer and regulatory demands for greener products. |

Emerging Innovations in Textile Chemicals: For an in-depth look at the latest breakthroughs in textile chemical products, including exciting product launches and company-specific innovations, check out our detailed article on emerging innovations in textile chemicals, news, product launches, and companies.

Choosing the Right Suppliers

- Selecting Chemical Partners:

- Manufacturers should prioritize suppliers that demonstrate a strong commitment to sustainability, R&D, and compliance with global regulations. Look for suppliers like Clariant, BASF, and Archroma, who are leading the way in eco-friendly solutions and are well-versed in regulatory compliance.

- Key Criteria for Choosing Suppliers:

- Sustainability: Choose partners with a clear focus on reducing the environmental footprint of their products.

- Product Innovation: Ensure that suppliers are investing in R&D for the development of performance-enhancing and sustainable chemicals.

- Compliance: Make sure your suppliers are up-to-date with global and local regulations, including REACH, BIS norms, and GST updates.

- Long-Term Partnership:

- Foster strong, long-term relationships with chemical suppliers who can provide consistent quality, reliability, and access to cutting-edge innovations.

Trusted Platforms for Updates

Staying informed with the latest news for textile chemicals is essential for navigating this fast-evolving industry. From trusted platforms to in-depth market research reports, the following sources offer valuable insights into sustainability trends, regulatory updates, and innovation forecasts shaping the textile chemical landscape in 2025.

| Category | Source | Source |

| Trusted Platforms | Fibre2Fashion | Provides updates on textile chemicals, sustainability trends, and industry innovations. |

| Techtextil News | Covers the latest trends in technical textiles and performance chemicals. | |

| Chemexcil | Offers insights into export trends, regulatory updates, and market forecasts in textile chemicals. | |

| Industry Reports | MarketsandMarkets | Projects the textile chemicals market to reach $33.1 billion by 2026. |

| SNS Insider Research | Tracks growth and investment trends in the textile chemicals sector. |

Frequently Asked Questions

What are the key news for textile chemicals in 2025?

Key news for textile chemicals in 2025 include stricter environmental rules, rising bio-based chemicals, PFAS alternatives, and low-water processing technologies.

How is the textile industry currently positioned?

India’s textile industry in 2025 is experiencing a strategic transformation driven by sustainability, technological upgrades, and expanding global trade opportunities. Government support through increased budget allocations, the PLI scheme, and targeted missions like the Cotton Productivity Initiative are enhancing competitiveness. Additionally, there’s a growing focus on eco-friendly processes, circularity, and the use of advanced textile chemicals aligned with international standards.

Which chemical is used in textile?

Textile production involves various chemicals depending on the process stage:

- Pretreatment: Caustic soda, soda ash, hydrogen peroxide

- Dyeing and Printing: Reactive dyes, disperse dyes, pigment colors

- Finishing: Silicone softeners, formaldehyde resins, flame retardants

- Sustainable Alternatives: Enzyme-based chemicals, biodegradable softeners, and bio-based surfactants are increasingly adopted to reduce environmental impact.

What is new in the textile industry?

The textile industry in 2025 is embracing innovations such as:

- Sustainable raw materials and green chemicals

- Smart textiles with embedded technology

- Circular production models and textile recycling

- AI-integrated manufacturing and supply chain traceability

These developments reflect a broader global push toward performance, transparency, and sustainability.

Which is the No. 1 textile city in India?

Surat, located in Gujarat, is considered the leading textile city in India. Known for its large-scale production of synthetic fabrics and sarees, Surat plays a pivotal role in India’s textile exports and continues to grow as a hub for innovation and manufacturing efficiency.

Also Read: Textile Chemicals: The Secret Sauce Behind Your Clothes