Tax Percentages for Textile Chemicals in India might sound dry as a subject at first glance, but they’re the lifeblood of how this industry operates in India. The interplay of percentages here has a direct effect on production costs, pricing strategies, and profit margins. Curious about why this matters so much? Imagine this: a minor adjustment in tax rates could turn a cost-effective manufacturing process into an unprofitable one, forcing businesses to rethink their strategies to stay competitive. Whether you’re a manufacturer or supplier, understanding these percentages is your compass in this financial maze. So, let’s peel back the layers and uncover why these numbers matter so much.

Table of Contents

Tax Percentages for Textile Chemicals in India

When it comes to textile chemicals, the tax structure in India isn’t just a list of percentages—it’s a complex web that shapes the entire industry. From GST rates to import duties and occasional state-specific levies, every tax type influences costs and competitiveness.

The Goods and Services Tax (GST) forms the backbone of this framework, with specific rates assigned to different chemical categories like dyes, auxiliaries, and surfactants.

But GST isn’t the only factor. Import duties come into play for businesses sourcing chemicals from overseas. These rates vary depending on whether the chemicals are essential or fall under restricted categories.

Additionally, some states impose localized taxes or offer incentives, creating variations that businesses must account for. Keeping track of these tax structures is crucial for maintaining profitability and compliance in the textile industry.

Here’s a quick snapshot of key components of the tax structure and Tax Percentages for Textile Chemicals in India:

| Tax Component | Applicability | Description |

| GST (Goods and Services Tax) | Applied to all textile chemicals sold within India | Typically ranges between 12% to 18%, based on the chemical’s classification under HSN codes. |

| Import Duties | Applicable to chemicals imported into India | Rates vary from 5% to 10%, with additional cess in some cases. |

| State Levies | Specific to states, for chemicals manufactured or transported within state boundaries | Rates differ across states, with some offering tax rebates to encourage local production. |

| Cess (if applicable) | Additional tax on certain chemicals considered environmentally hazardous or luxury items | Calculated as a percentage of the basic duty or GST rate. |

Each tax impacts the cost chain differently, making it vital for businesses to stay informed. Miss a single detail, and it could cost more than a few rupees—both in compliance and operational efficiency.

SAC Code for Labour Charges Textile Chemicals

You will encounter SAC when maintaining the accounts for textile chemicals manufacturing. The correct SAC (Services Accounting Code) is 998739, which falls under “Other support services – subcontracted labour”. This code is applicable when labour charges are incurred for processing or handling textile chemicals. Ensure proper classification under GST to avoid compliance issues and streamline your invoicing process effectively. Read our detailed blog in the matter of SAC Code for Labour Charges Textile Chemicals.

GST Rate on Textile Chemicals

The GST rate on textile chemicals generally usually falls under the 18% slab, which includes dyes, dyeing auxiliaries, finishing agents, and other chemical preparations used in the textile industry. These chemicals are essential for processes like bleaching, dyeing, printing, and finishing fabrics. However, classification may vary depending on the exact composition and usage of the product. It’s crucial to refer to the HSN code for accurate tax applicability. Read our detailed blog in the matter of GST rate on textile chemicals. For seamless compliance, consult a GST expert or refer to official GST notifications for updates.

Textile Chemicals HSN Code

The textile chemicals HSN Code is generally classified under HSN 3809, which covers chemical preparations used in textile processing, such as finishing agents, dyeing auxiliaries, and softening or water-repellent compounds. These chemicals play a key role in enhancing fabric quality, durability, and appearance. Accurate HSN classification is essential for global trade, ensuring transparency in documentation, taxation, and customs processes. Depending on the specific chemical and its application, further subcategories may apply. Read our detailed blog on Textile Chemicals HSN Code which also has information on HSN codes for India as well. Always refer to official HSN directories or consult trade compliance experts for accurate classification.

Import Duties on Textile Chemicals

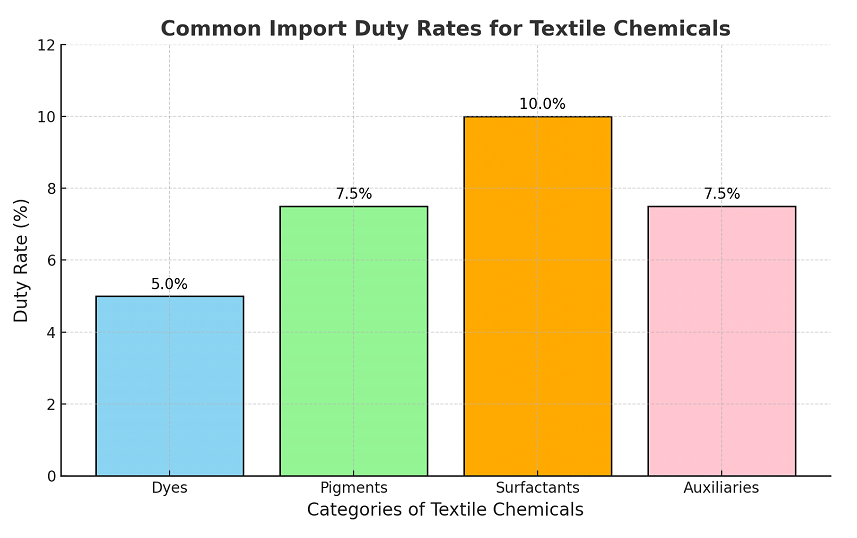

Understanding the variation in import duty rates is critical for textile manufacturers to optimize their cost structures. The chart below highlights the Basic Customs Duty rates for different categories of textile chemicals, offering a visual comparison on the Tax Percentages for Textile Chemicals in India.

This comparison clearly illustrates how duty rates differ based on chemical categories, influencing sourcing decisions and overall production costs. Manufacturers should analyze these rates carefully to maintain profitability and competitiveness.

Let’s dive into the key aspects:

By understanding these aspects of Tax Percentages for Textile Chemicals in India, textile manufacturers can effectively manage import duties, streamline supply chains, and maintain competitiveness.

| Aspect | Details |

| Duty Rates | Basic Customs Duty: 5% to 7.5% for many textile chemicals. |

| Integrated Goods and Services Tax (IGST): 18% or 28% depending on the chemical category. | |

| Exemptions | Duty-free Imports: Under schemes for R&D or manufacturing exports. |

| Special Exemptions: For goods imported for personal use or scientific research. | |

| Implications for Businesses | Increased Costs: High duties raise production costs, impacting competitiveness. |

| Market Challenges: Higher costs make Indian textiles less competitive globally. | |

| Key Considerations | Stay Updated: Regularly monitor government notifications and consult customs brokers. |

| Duty Structure Analysis: Optimize import costs and profitability through detailed analysis. | |

| Duty-Saving Mechanisms: Leverage FTAs and specific exemptions to reduce duties. |

State-wise Tax Variations in India

While the Goods and Services Tax (GST) aims to create a unified tax regime across India, some variations in Tax Percentages for Textile Chemicals in India can still exist at the state level.

| Aspect | Details |

| State-specific Levies | Additional levies or cesses imposed by some states on goods and services, including textile chemicals. |

| Varying rates across states impact the overall tax burden on manufacturers. | |

| Exemptions and Incentives | Reduced Tax Rates: Lower GST or exemptions from certain state-level taxes. |

| Subsidies and Grants: Financial assistance to support textile industry growth. | |

| Simplified Tax Procedures: Streamlined processes for tax filing and compliance. | |

| Impact on Businesses | Increased Complexity: Managing diverse tax structures across multiple states. |

| Competitive Advantages: States with favorable tax regimes attract more investment. | |

| Strategic Planning: Optimizing operations based on tax implications in different states. | |

| Key Considerations | Monitor State Tax Policies: Stay informed on changes that affect your business. |

| Consult Tax Experts: Gain professional advice on tax implications in various states. | |

| Leverage Incentives: Utilize state-level incentives to reduce tax burdens and boost competitiveness. |

This structured overview helps businesses navigate state-specific taxes, maximize incentives, and strategically optimize operations.

Tax Benefits and Exemptions

The Indian government offers various tax benefits and exemptions to encourage growth and investment within the textile sector. These incentives aim to boost competitiveness, promote exports, and create employment opportunities.

| Category | Details |

| GST Benefits | Lower GST Rates: Concessional rates on textile products and chemicals. |

| Input Tax Credit (ITC): Avail ITC on eligible inputs to reduce tax liabilities. | |

| Income Tax Benefits | Deductions & Exemptions: For investments in R&D, plant, and machinery. |

| Other Incentives | Export Promotion Schemes: Incentives like MEIS for textile exporters. |

| State-level Incentives: Reduced tax rates, subsidies, and simplified procedures. | |

| Key Considerations | Eligibility: Meet criteria and comply with regulations. |

| Stay Updated: Monitor changes and consult tax professionals. | |

| Claim Benefits: Follow procedures to maximize tax savings. |

This table provides a clear and concise overview of the available tax benefits and their impact on the textile industry.

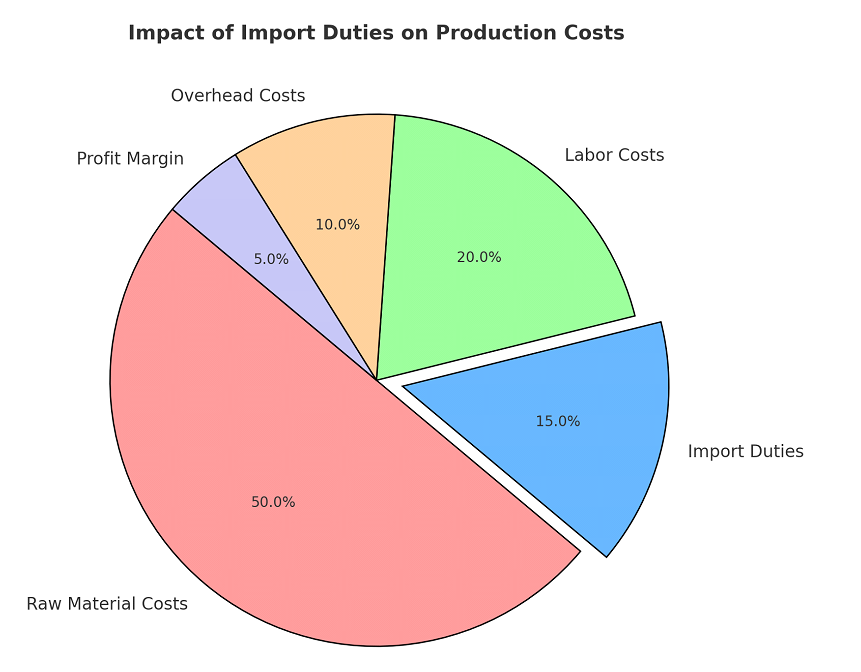

Impact of Taxation on Pricing and Profitability

Taxation plays a pivotal role in shaping the cost structure and pricing strategies within the textile supply chain. Let’s explore how:

| Aspect | Details |

| Increased Costs | Direct Costs: Taxes on raw materials (input costs) and finished goods (output taxes). |

| Indirect Costs: Compliance expenses and supply chain disruptions. | |

| Pricing Strategies | Cost-Plus Pricing: Passing tax costs to consumers through higher prices. |

| Competitive Pricing: Limited ability to increase prices, squeezing margins. | |

| Tax-Driven Innovation: Optimizing operations and leveraging tax incentives. | |

| Profitability Impact | Reduced Margins: Higher taxes directly reduce profitability. |

| Competitive Disadvantage: High-tax regions face challenges against low-tax counterparts. | |

| Discouraged Investment: Heavy tax burdens may deter sector investments. | |

| Key Considerations | Tax Burden Analysis: Evaluate taxes across the supply chain. |

| Tax Planning: Use strategies to reduce liabilities and boost competitiveness. | |

| Policy Advocacy: Push for supportive tax policies through industry groups. |

Compliance Requirements

Navigating the tax landscape in India requires meticulous adherence to a set of compliance requirements. Let’s delve into the key aspects of Tax Percentages for Textile Chemicals in India:

| Compliance | Key Points |

| GST | Registration, timely invoicing, returns filing, ITC utilization, record-keeping. |

| Income Tax | Annual returns, TDS compliance, advance tax payments. |

| Customs | Import declarations, timely duty payments, regulatory adherence. |

| Penalties | For late filing, incorrect reporting, or non-compliance in GST, income tax, or customs. |

| Key Tips | Hire professionals, stay updated, and use technology to simplify compliance. |

This ultra-condensed version highlights only the essentials for quick reference.

Trends of Tax Percentages for Textile Chemicals in India

The scenario for Tax Percentages for Textile Chemicals in India is constantly evolving. Recent changes and emerging trends have significant implications for manufacturers and importers within this sector.

| Aspect | Details |

| GST Rate Revisions | Periodic revisions impact costs and competitiveness; monitor notifications for updates. |

| Technology & Digitization | E-invoicing/E-way Bills: Mandatory for many; streamlines compliance. |

| GSTN Updates: Stay updated for efficient tax administration. | |

| Ease of Doing Business | Simplified tax processes, automated calculations, and online dispute resolution initiatives. |

| Emerging Trends | Sustainability: Potential incentives for eco-friendly practices. |

| Data & AI: Enhanced tax audits and risk assessments through advanced technologies. |

This summary provides a quick reference to recent developments and trends in GST and tax administration.

Challenges and Solutions

Navigating the tax landscape for textile chemicals in India presents several challenges for businesses.

| Challenges | Details |

| Complex Tax Laws | Multiple taxes, varying rates, frequent changes increase compliance difficulty. |

| Clarity Issues | Ambiguity in laws and differing interpretations lead to disputes. |

| High Compliance Costs | Time-consuming and costly compliance processes. |

| Frequent Policy Changes | Uncertainty and disruptions from frequent regulatory updates. |

| State-Level Variations | Tax rate differences across states complicate operations |

| ITC Issues | Challenges in claiming/utilizing Input Tax Credit (ITC), blocking capital. |

| Solutions | Details |

| Professional Guidance | Hire tax consultants and CAs to ensure compliance. |

| Stay Updated | Follow official channels and advisories for tax law changes. |

| Technology Adoption | Use robust accounting and inventory systems for streamlined compliance. |

| Tax Planning | Strategize to minimize liabilities and optimize cash flow. |

| Strategize to minimize liabilities and optimize cash flow. | Collaborate with industry bodies to push for favorable tax policies. |

| Leverage Technology | Utilize e-filing portals and online tools to simplify processes. |

| Utilize e-filing portals and online tools to simplify processes. | Maintain open communication with tax authorities to resolve disputes. |

This streamlined table highlights common challenges and actionable solutions for efficient tax management.

Role of Professional Tax Consultants

Navigating the complex tax landscape for textile chemicals in India can be a daunting task for businesses. This is where professional tax consultants play a crucial role.

| Role | Details |

| Expert Guidance | Industry-specific advice on GST, income tax, customs duties, and state taxes. |

| Tax Planning & Optimization | Minimize liabilities by identifying deductions, exemptions, and incentives. |

| Compliance Assistance | Ensure adherence to tax laws, including GST, income tax, and customs requirements. |

| Risk Mitigation | Identify and address potential tax risks to avoid penalties and disputes. |

| Staying Updated | Provide timely updates on changes in tax laws and policies. |

| Representation & Advocacy | Represent businesses in audits, assessments, and disputes with tax authorities. |

| Benefits of Consulting | Details |

| Reduced Tax Liabilities | Effective planning lowers tax burdens, boosting profitability. |

| Enhanced Compliance | Ensure compliance with tax regulations to prevent incurring penalties. |

| Peace of Mind | Expert handling of tax matters allows focus on core business activities. |

| Improved Efficiency | Streamlined processes save time and resources. |

| Proactive Approach | Early resolution of issues ensures financial stability. |

This table showing the benefits of consulting for the Tax Percentages for Textile Chemicals in India offers a concise overview of the functions and benefits associated with hiring tax consultants for textile enterprises.

Engaging qualified tax consultants is vital for textile chemical businesses to navigate complex tax laws, reduce liabilities, and secure long-term financial stability.

Disclaimer: This information is for general guidance only and not a substitute for legal or tax advice. Consult qualified professionals for tailored advice.

Conclusion

In conclusion, understanding the Tax Percentages for Textile Chemicals in India is crucial for businesses aiming to navigate the complex regulatory environment efficiently. Staying updated with GST rates, exemptions, and category-specific rules helps manufacturers and suppliers make informed decisions. As the textile industry evolves, so will its tax implications—making it essential to stay aware and compliant for long-term growth and competitiveness in the Indian and global markets.

Frequently asked questions

What is the tax on chemicals in India?

A: Most chemicals in India attract an 18% GST rate, though some may vary based on classification.

What is the tax rate on textiles in India?

A: The GST on textiles generally ranges from 5% to 12%, depending on the type and stage of production.

What is the GST rate for textile chemicals in India?

A: Textile processing chemicals typically fall under the 18% GST slab as part of industrial chemical inputs.

Also Read: Textile Chemicals: The Secret Sauce Behind Your Clothes